- HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 HOW TO

- HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 UPDATE

- HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 FULL

For example, if you take a trip and spent a lot on airfare, you can apply the reward refund to that same travel expense category that you originally used for the transaction.

HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 UPDATE

Update me if you have additional questions or if you need further assistance with the process. A little web research brought up two approaches for recording credit card cash rewards in QuickBooks.

HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 HOW TO

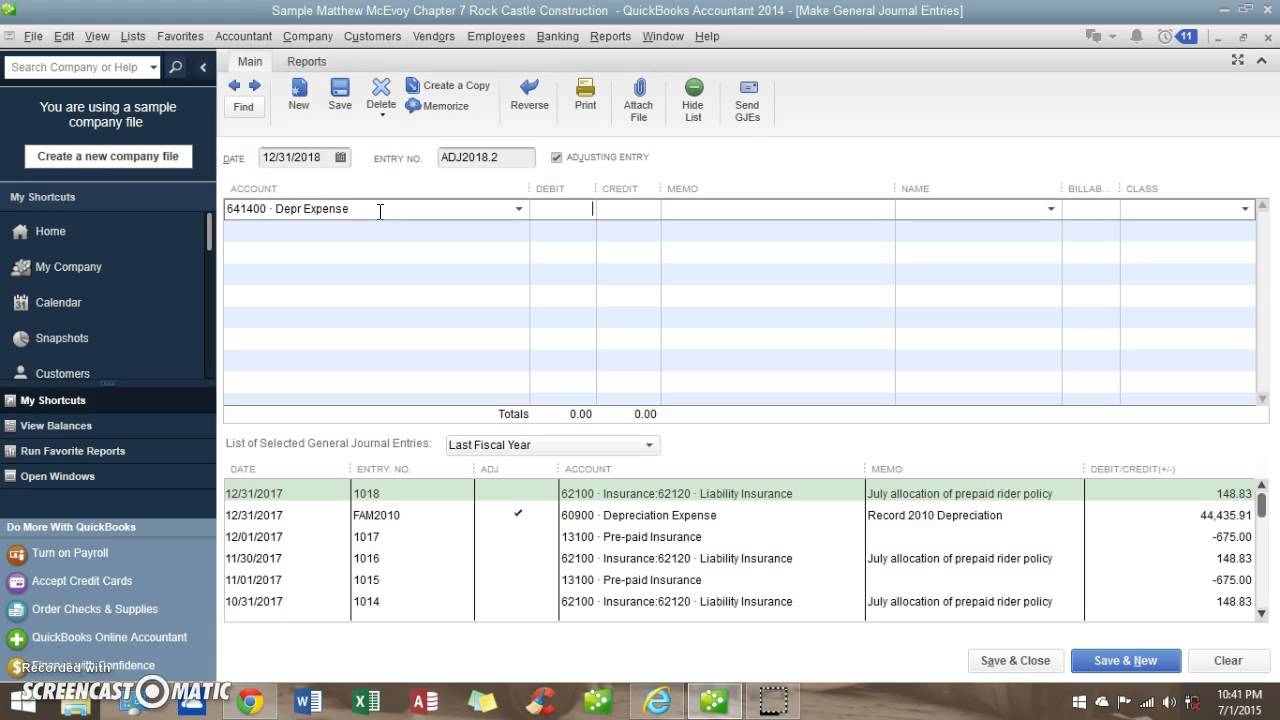

This book allows the students to see why events are recorded the way they. How to record a refund in QuickBooks Online using the api Ask Question Asked 8 years, 11 months. Record sale of supplies At the end of the accounting period, ledger requires some alterations and adjustments which is done by adjsuting journal entries Periodic System a transfer of a partnership interest by sale or exchange, or upon the death of a partner5 (this basis adjustment is computed under IRC Sec I recommend creating a. Once done, assign it to your vendor transactions. Computerized Accounting with Quickbooks 2015 by Williams, 978-1-61853-200-8. a uniform bar of mass m and length l is hinged to a shaft. When you run a report on your revenue and expenses accounts, you will see a total of 500 (300 for the rental + 200 for the coffee break.

HOW TO RECORD EXPENSES IN QUICKBOOKS 2015 FULL

Allow me to help you record the taxes on your purchases.Īt the moment, QuickBooks is not designed to track sales tax automatically on non-sales transactions. To record this, create a new expense account for the tax then add them to expenses, bills, checks and purchase orders.

Hey there, for adding additional information about the issue.

0 kommentar(er)

0 kommentar(er)